Fully on a wartime footing: Ukraine's economy is working for defence

Russian forces are systematically carrying out drone and missile strikes on Ukrainian defence industry facilities. Yet this campaign has produced no noticeable results: Kyiv's defence production has endured the attacks and even increased its output.

Official statistics indicate that from January to September 2025, Ukraine's entire industrial sector produced goods worth UAH 2.94 trillion (about US$70 billion), a nominal increase of 14% compared with the same period last year. In real terms, however, output fell by 2%.

To distinguish civilian production from the military sector, Ekonomichna Pravda analysed data from Ukraine's State Statistics Service on output across more than 150 industrial sub-sectors from early 2021 to September 2025. From this dataset, it identified 30 sub-sectors that directly or indirectly support the defence sector.

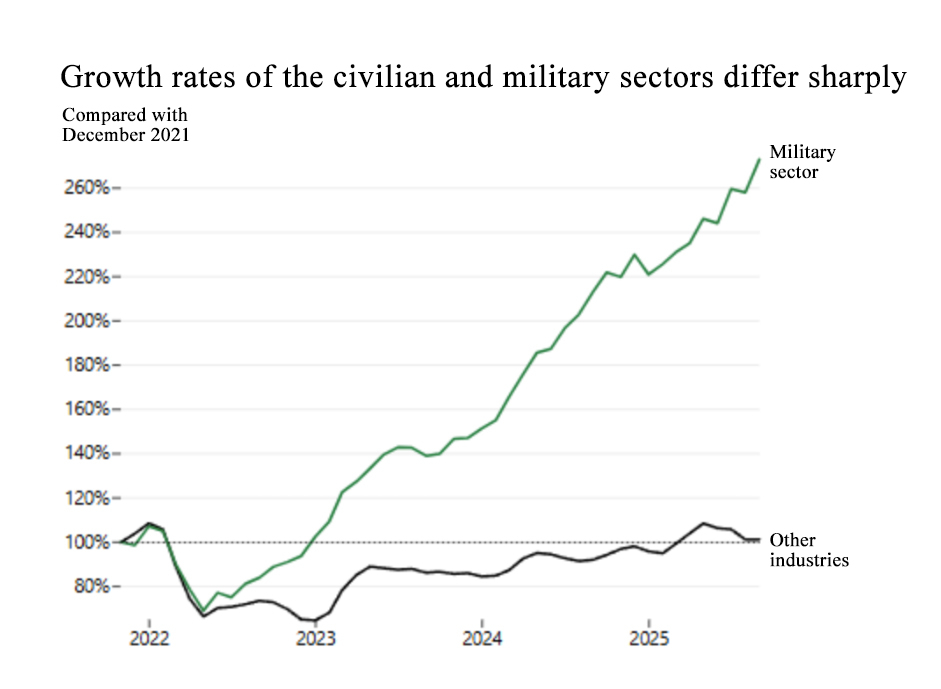

The picture is striking. In December 2024, production in the defence industry doubled, compared with the same month in 2023, and in the first nine months of 2025, it increased by more than 2.5 times. The industry's output reached an estimated UAH 420 billion (US$9.9 billion) in 2024, and in January-September 2025 alone, it stood at UAH 390 billion (US$9.2 billion).

These figures align with the government's official estimates – military production rose from roughly US$3 billion in 2023 to around US$9 billion in 2024.

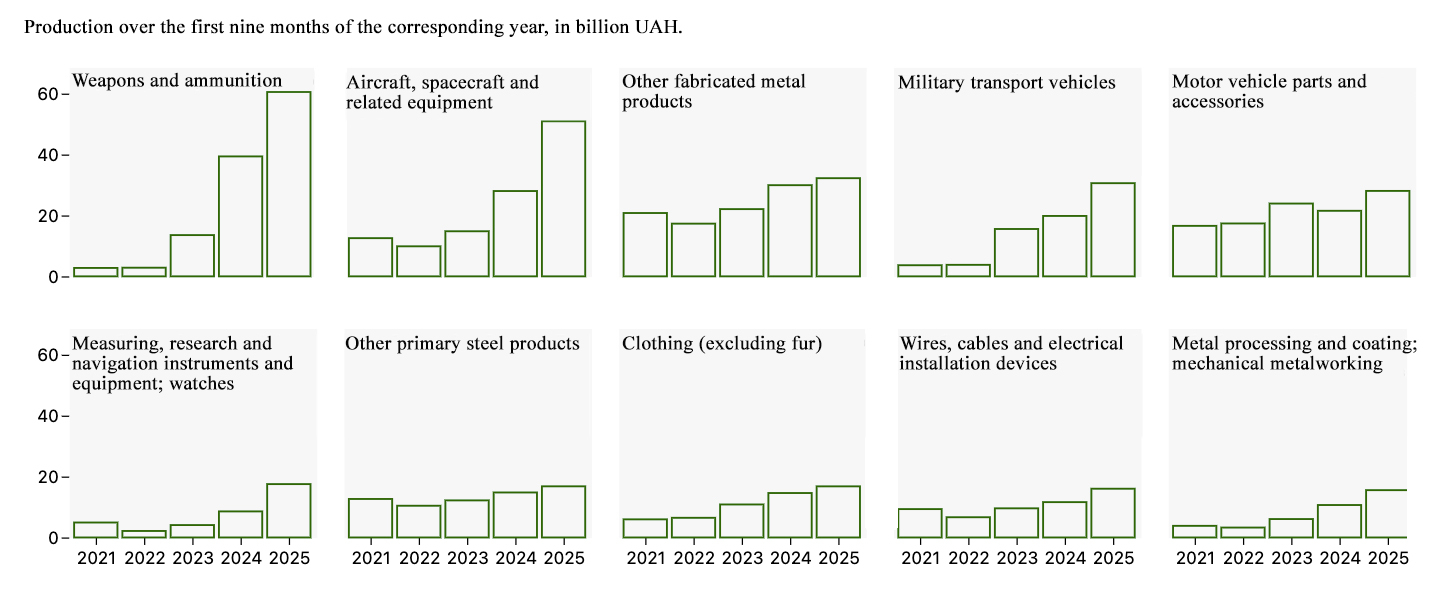

Several key areas are driving the wartime industrial boom. Leading the way is the production of weapons and ammunition, a sector that has rebounded after decades of stagnation. In the first nine months of 2025, output in this sector increased 1.5 times compared with the same period in 2024, reaching an estimated UAH 60 billion (US$1.4 billion).

More than 30% of the weapons used by the Ukrainian military come from the national industry. Production of ammunition, including large calibres such as 155mm artillery shells, has been re-established across the entire spectrum.

The drone sector shows similar scale and growth. The establishment of production for various drone types has enabled a significant increase in output. In the first nine months of 2024, the value of manufactured drones was estimated at UAH 28 billion (US$660 million), rising to UAH 50 billion (US$1.18 billion) in the same period of 2025.

The production of high-precision optics, night vision devices, thermal imaging systems, and navigation devices has more than doubled. They form part of the larger electronics and instrument engineering segment, one of the most rapidly expanding areas in Ukraine's defence industry.

Even light industry is seeing substantial growth. Companies producing uniforms, load-bearing equipment and ammunition have nearly doubled their output during the war years.

Official statistics, however, only show the tip of the iceberg. About 90% of defence industry companies do not have a military KVED (Classifier of Economic Activities), according to Andrii Teliupa, Ukraine's Deputy Minister for the Economy, Environment and Agriculture. These companies produce components or assemblies essential to the final product but fall outside specialised support programmes.

"You don't even identify them as defence companies. Perhaps this is for the best in wartime", says Teliupa.

Some key industries related to the defence sector

In fact, the defence sector represents nearly all of Ukraine's real industrial production growth.

In contrast, civilian industry is losing ground. At the start of 2025, its nominal hryvnia output surpassed the December 2021 level for the first time. However, this gain proved short-lived: the energy crisis, Russian strikes and high production costs quickly erased all progress.

Ukrainian industry is operating amid severe electricity shortages and persistent blackouts – a situation especially critical for large manufacturers. In 2022, Ferrexpo, a Swiss-based commodity trading and mining company, was forced to shut down two mining and processing plants in Ukraine. Metinvest Group, a steel and mining group, cut steel production. Meanwhile Interpipe, a Ukrainian pipe manufacturer, fulfilled only a small number of specific orders. In 2025, the situation is repeating itself.

Power shortages, high electricity prices, a damaged grid and the risk of emergency shutdowns make production both unstable and costly. For energy-intensive facilities, sudden outages can result in millions in losses and damage to equipment.

As a result, a significant portion of the civilian sector, ranging from the metallurgical industry to plastics production, is in decline. This weakens the country's export potential and limits the prospects for a rapid economic recovery.

Translation: Artem Yakymyshyn

Editing: Shoël Stadlen